Gala Precision Engineering working for 175+ global customers across 25+ countries like Germany, Denmark, USA, and Switzerland etc and has office in Frankfurt Germany which caters to existing and potential clientele in Europe

Gala Precision Engineering IPO is coming with price band of around ₹503 to ₹529 per share with min lot size 28 Shares.

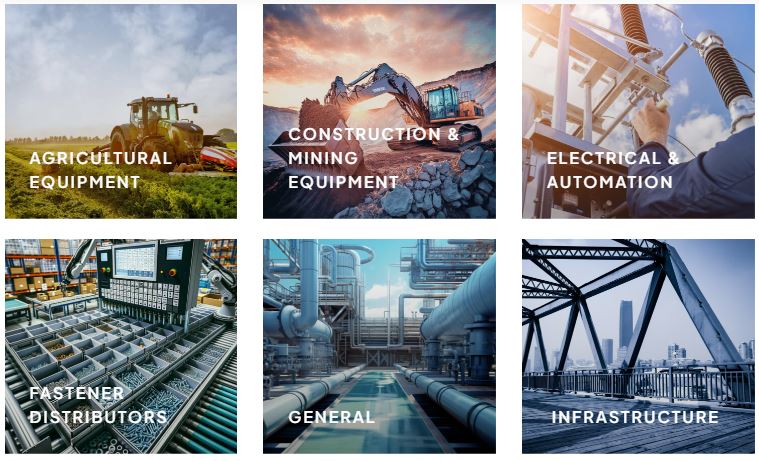

Industries served

Industrial

Gala Precision Engineering IPO FAQs

Objectives of the Issue

New Manufacturing Facility : Set up a new plant in Tamil Nadu

Capital Expenditure : Fund the purchase of equipment, plant, and machinery at the Wada facility in Maharashtra.

Debt Repayment: Repay or prepay part of the company’s existing loans

General Corporate Purposes: Use funds for various corporate needs.

Issuance Period for Gala Precision Engineering IPO :

Gala Precision Engineering IPO subscription starts from September 2, 2024 and will be available till September 4, 2024.

| Event | Date |

|---|---|

| IPO Opening Date | September 2, 2024 |

| IPO Closing Date | September 4, 2024 |

| Allotment Finalization Date | September 5, 2024 (Thursday) |

| Tentative Listing Date | September 9, 2024 (Monday) |

| Stock Exchange Listing | BSE, NSE |

Table of Contents

IPO Size :

Gala Precision Engineering IPO: amount to be raised Rs 167.93 crores.

GMP ( Grey market Premium )

| Date | Current GMP (₹) | Percentage (%) |

|---|---|---|

| August 31, 2024 | ₹240 | 45.37% |

| September 3, 2024 | ₹268 | 50.6% |

| September 4, 2024 | ₹230 | 43.48% |

| September 5, 2024 | ₹260 | 49% |

| September 6, 2024 |

Lot Size :

| Investor type | Lots | Number of Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 28 | ₹14,812 |

| Retail (Max) | 13 | 364 | ₹192,556 |

| S-HNI (Min) | 14 | 392 | ₹207,368 |

| S-HNI (Max) | 67 | 1,876 | ₹992,404 |

| B-HNI (Min) | 68 | 1,904 | ₹1,007,216 |

Gala Precision Engineering IPO Details :

| Detail | Information |

|---|---|

| Draft Red Herring Prospectus Date | February 14, 2024 |

| Company Name | Gala Precision Engineering Limited |

| Incorporation Date | February 23, 2009 |

| Name Change to Public Company | October 25, 2023 |

| IPO Size | – Fresh Issue: Up to 2,558,416 Equity Shares |

| – Offer for Sale: Up to 616,000 Equity Shares | |

| – Total Offer Size: Up to 3,174,416 Equity Shares | |

| Promoters | Kirit Vishanji Gala and Smeet Kirit Gala |

| Registrar to the Offer | Link Intime India Private Limited |

| Book Running Lead Manager | PL Capital Markets Private Limited |

| Face Value | ₹10 per share |

| Price Band | ₹503 to ₹529 per share |

| Lot Size | 28 Shares |

| Listing on Stock Exchanges | BSE and NSE |

Gala Precision Engineering Financial Information :

| Category | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

|---|---|---|---|

| Assets | ₹188.69 Cr | ₹170.39 Cr | ₹145.62 Cr |

| Revenue | ₹204.38 Cr | ₹167.08 Cr | ₹147.96 Cr |

| Profit After Tax | ₹22.33 Cr | ₹24.21 Cr | ₹6.63 Cr |

| Net Worth | ₹104.45 Cr | ₹83.66 Cr | ₹59.32 Cr |

| Reserves and Surplus | ₹94.67 Cr | ₹81.13 Cr | ₹56.79 Cr |

| Total Borrowing | ₹55.03 Cr | ₹58.60 Cr | ₹56.89 Cr |

About Company

Specialization

Gala Precision Engineering specializes in designing and manufacturing precision components, including High Tensile Fasteners, Disc & Strip Springs, Coil & Spiral Springs, and Wedge Lock Washers

Products adhere to global standards like German DIN and can be customized to meet specific customer requirements

Clientele and Market Reach

Primary clients are major OEMs, Tier-1 suppliers, and channel partners across industries such as Renewable Energy, Industrial, and Mobility.

Gala serves over 175 global customers across 25+ countries, including Germany, Denmark, China, Italy, Brazil, USA, Sweden, and Switzerland.

International sales contribute approximately 40% of total revenue

Global Presence

The company has an office in Frankfurt, Germany, to serve existing and potential clients across Europe

Expansion

Gala is expanding its operations with a new facility in Vallam-Vadagal, SPICOT, Sriperumbudur, Tamil Nadu, dedicated to producing specialized fastening solutions

Experience and Competencies

With 30 years of experience, Gala has developed strong competencies in in-house tool design and development, material science, heat treatment, and surface engineering.

The company employs lean manufacturing practices and invests in semi-automation and automation to enhance productivity and eliminate errors.

Evolution and Milestones

| Year | Milestone |

|---|---|

| 1989-1994 | – Established as manufacturers of Disc Springs & Mass Finishing Systems (MFS) in India. |

| – Set up a new plant for Compressor Valves. | |

| 1995-1999 | – SAP implementation & TS 16949 certification by BVQi. |

| 2000-2009 | – Established China Plant and exited Compressor Valves business to Hoerbiger. |

| – Developed spring assemblies for the power sector, expanded Disc Springs range, and collaborated with German universities for technology advancements. | |

| 2010–2015 | – Commissioned new plant for Coil Springs. |

| 2016 | – Received award from ABB, Germany for Disc Springs as one of the top 10 suppliers. |

| – VDA 6.3 plant audited and approved by Tier-1 companies like Valeo, Schaefller, Rane TRW (ZF). | |

| 2017-2018 | – Commenced fasteners plant; Gallock Wedge Lock Washers approved by Indian Railways as an import substitute. |

| – Launched Gallock Wedge Lock Washers in India for off-highway vehicles and heavy machinery. Invested in advanced thread rolling machinery for large stud production. | |

| 2019-2020 | – Entered Compression Springs market for Indian Metro Rails as import substitute. |

| – Secured orders from leading wind turbine manufacturers for Foundation Studs & Gallock Wedge Lock Washers. | |

| – Achieved significant market presence of Disc Springs in Europe. | |

| 2021-2022 | – Began exporting fasteners to Europe and USA. |

| – Expanded manufacturing in Chennai, focusing on High Tensile Fasteners product range. | |

| 2023 | – Continued strategic growth and expansion efforts. |

IPO Prospectus

Gala Precision Engineering IPO DRHP

- P N Gadgil Jewellers Limited IPO

- Bajaj Housing Finance IPO – GMP, Date, Price Everything you need to know

- Gala Precision Engineering IPO GMP: Key Information You Shouldn’t Miss

- Top Questions About Baazar Style Retail IPO Answered

- Baazar Style Retail IPO: Everything You Need to Know

- Don’t Risk Your Retirement: Things You Need to Know About the Unified Pension Scheme