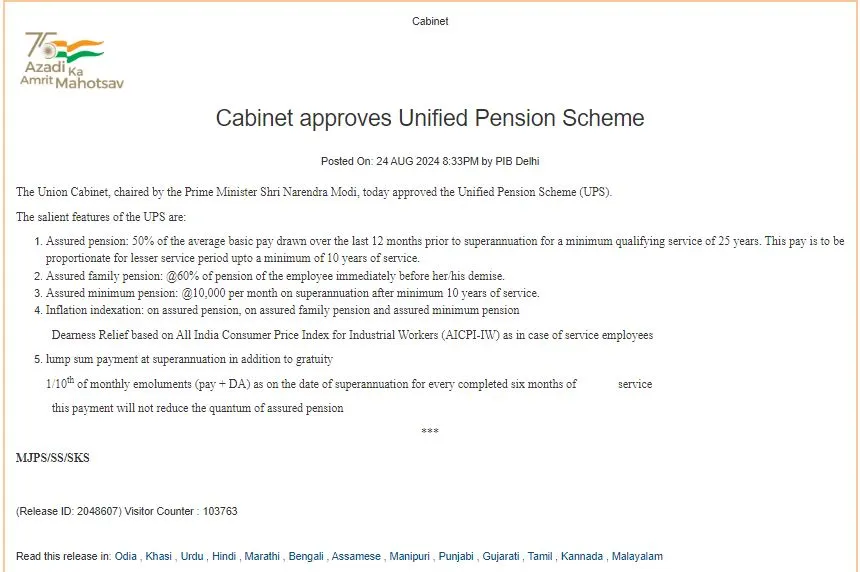

The Union Cabinet, chaired by the Prime Minister Shri Narendra Modi, approved the Unified Pension Scheme (UPS) on 24 August 2024 which will benefit around 23 lakh Government employees and will be effective from effective from April 1, 2025.

Prime minister Narendra Modi, posted on X saying, ““The Unified Pension Scheme ensures dignity and financial security for government employees, aligning with our commitment to their well-being and a secure future.”

Table of Contents

Salient Features of the Unified Pension Scheme (UPS)

1.Assured pension

Under the Unified Pension Scheme , retirees are assured a pension equal to 50% of the average basic pay drawn over the last 12 months prior to superannuation for a minimum qualifying service of 25 years. This pay is to be proportionate for lesser service period upto a minimum of 10 years of service.

Example 1: Retiree with 25 Years of Service

Imagine an employee named A, who is about to retire after 25 years of service. His average basic pay over the last 12 months before his retirement is ₹50,000 per month.

Assured Pension Calculation:

Since Rajesh has completed the minimum qualifying service of 25 years, he is eligible to receive a pension that equals 50% of his average basic pay.

50% of ₹50,000 = ₹25,000.

Example 2: Retiree with 15 Years of Service

consider another employee, B, who is retiring after 15 years of service. Her average basic pay over the last 12 months is also ₹50,000 per month. Since B has served less than 25 years but more than the minimum 10 years, her pension will be proportionately calculated.

Proportional Pension Calculation: The pension amount is calculated by reducing the percentage of the pension based on the number of years served. Let’s assume the pension is reduced proportionately from the 50% that would apply for a full 25 years of service.

Pension Percentage=(15/25)×50%=30%

30% of ₹50,000 = ₹15,000.

2.Assured Family Pension:

@60% of pension of the employee immediately before her/his demise.

Example

Let’s say an employee named A was receiving a monthly pension of ₹30,000 at the time of his passing. His family would be entitled to a family pension under the Unified Pension Scheme.

Family Pension=60% of ₹30,000=₹18,000

3.Assured minimum pension

@10,000 per month on superannuation after minimum 10 years of service.

Example 1: Retiree with Low Average Basic Pay

Imagine an employee named A , who is retiring after 12 years of service. His average basic pay over the last 12 months before retirement is ₹15,000 per month.

Proportional Pension Calculation: Using the formula to calculate the proportionate pension:

Pension Percentage =(12/25)×50%=24%

- 24% of ₹15,000 = ₹3,600.

Assured Minimum Pension: Since ₹3,600 is less than the assured minimum pension, A will receive the guaranteed minimum pension of ₹10,000 per month instead of ₹3,600 under Unified Pension Scheme.

4. Inflation indexation:

On assured pension, on assured family pension and assured minimum pension

Dearness Relief based on All India Consumer Price Index for Industrial Workers (AICPI-IW) as in case of service employees.

Example: Inflation Indexation in Action

Let’s consider a retiree named B, who is receiving a monthly pension of ₹20,000. Over the next year, inflation causes prices to rise, and the government announces a 5% increase in the Dearness Relief (DR) based on the AICPI-IW.

Original Pension: B’s original pension is ₹20,000 per month.

Inflation Adjustment: With the 5% increase in Dearness Relief, B’s pension will be adjusted to account for inflation. The increase is calculated as:

Increase=5% of ₹20,000=₹1,000

New Pension Amount: ₹20,000+₹1,000=₹21,000

5. lump sum payment at superannuation in addition to gratuity

1/10th of monthly emoluments (pay + DA) as on the date of superannuation for every completed six months of service.